Side-gigs, from blogging and life coaching to accounting, are quickly becoming an essential part of building a successful career in the new economy.

Professional networking sites, mainly LinkedIn, are a great resource to grow your potential client base. You can finesse your ‘personal brand’, seek out new opportunities and make advantageous connections.

But it can be tricky to use LinkedIn when you already have a job.

I started my accounting business while working elsewhere. This can be tricky as your main job is your bread and butter and you do not want to jeopardize that.

But you also need to use LinkedIn to make yourself presentable and connect to the market you want as clients. Ahhhh! It all seems overwhelming right? Read below for my top tips of how to be on LinkedIn for your side business without sacrificing your full time job.

Does Your Job Allow It

Some employers are OK with side hustles! Before you start jumping through hoops to try and stay incognito on your profile, test your work atmosphere. What does your employment agreement say? Are any other coworkers working on the side? If your employer allows side work, you are free to update your LinkedIn profile as needed.

Let’s Stop the Constant Updates

You know those annoying LinkedIn emails you get when Suzi updates her profile to add a new skill? Yeah let’s stop those.

When you are optimizing your personal profile for your new accounting business, we don’t want all of your coworkers and your network getting all those updates. Here is how you stop it:

Overall, go through the whole “Settings & Privacy” page and change your settings as you see fit.

Blocking

LinkedIn allows you to block users.

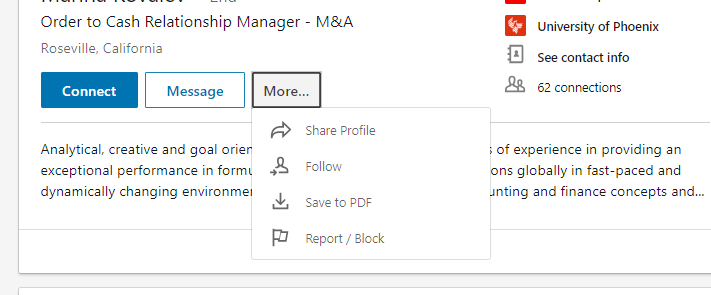

There is no mass block feature, but you are able to do it on a one by one basis. Go to the Users profile > Click “More” right under their picture > select “Block”. That person will be blocked from seeing anything about you.

If you choose to go this route, you can block all of your coworkers. This probably won’t work well if you work at a large CPA firm (or at least it’ll require effort to block a lot of people), but if you work for a smaller Company this can be a great way to stay private with your side business.

Create a Second Profile

If I had to start ALL OVER, I would go this route.

Have one LinkedIn profile that is your typical W-2 job profile.

Then I would create a 2nd profile (all you need is a separate email).

I would use my real name and real information. I would NOT have my current employer on there and would just have my current job as my side business. This way, any potential clients that view your page, see that you are running an accounting business and won’t be confused as to why you’re trying to do their tax return when your profile says you are a Customer Service Rep at Wells Fargo.

Now the picture is key here. Don’t mess this up! You don’t want to use the same picture as your main profile. I suggest doing a picture of your business logo as your profile picture, and having your personal pictures on your website.

Going the route of having 2 LinkedIn profiles lets you start building your side hustle network, while keeping your main profile intact. Don’t mess up on your LinkedIn side hustle profile by adding a close up of your face and you should be good to go!

These are my tips on starting your accounting business LinkedIn page while still employed. I hope these tips help you stay incognito, while also building up your firm!

If running an accounting firm or freelancing sounds like something you would be interested in but you don’t know where to start, go ahead and download my FREE Firm Quick Start Guide below.

Also make sure you check out my Inclusive Firm Course.

In this course I teach the exact steps I took to start my own accounting business, all the best technology and sales techniques out there, and much much more! You will be able to go out and start signing clients comfortably after going through my course.

If you prefer one on one consulting, we offer that as well! Click here to schedule a strategy session.

Do you have any other questions on what it is like to be a freelance accountant? Leave a comment below and I will get back to you!